This year, as worries about the company persisted, Nio stock price has been in a sharp downward trend. The price plummeted to $10.97, the lowest point since July 2020. From its peak, it has decreased by more than 83 percent. Since the shares have fallen more than 63% this year, they have underperformed compared to other EV stocks. Its market value has dropped to more than $18 billion.

Nio Stock News

Despite sharing some significant news recently, the Nio share price has recently fallen.

The most recent information on Nio concerned the most recent deliveries. As demand for electric vehicles increased, the company reported that it delivered a record 10,878 vehicles in September. The majority of these cars were high-end smart electric cars. The company achieved a quarter-over-quarter increase in sales of over 31,607, or about 29.3%. The company has sold over 249k cars overall this year.

Second, Nio’s operations are growing in Europe as well. In Germany, where it hopes to increase market share, it has already established a battery exchange station. One of the leading EV nations in the world, Norway, has seen the launch of two swap stations by the company. Nio aims to have more than 4,000 battery swap stations worldwide by 2025, with more than 1,000 in foreign countries.

Check More Stocks Information in BtcAdv Blog!

What Determines Nio’s Price?

The main factor influencing Nio’s price is the demand for electric vehicles. In the list below, we’ve outlined the key elements among the many others that also contribute.

- Electric vehicle sales. Demand for the electric vehicles that Nio designs, develops, and produces is essential to the company’s success. The EV market has expanded significantly in recent years. The demand for Nios products could increase further if that growth keeps up, which would be favorable for the share price.

- Competition. With the entry of new businesses and the expansion of established ones, the EV industry has grown more competitive. The well-known maker of electric cars Tesla may be Nio’s biggest rival. It most likely will have to fend off rivals if it hopes to succeed.

- Chinese market. Nio is a Shanghai-based company, and China is currently its biggest market. Even though it does export some cars, Chinese consumers’ purchases have helped the business advance. Sales of Nio cars would probably rise if China keeps moving toward the EV market.

- Manufacturing. Instead of producing its own cars, Nio has partnered with Jianghuai Automobile Group, a state-owned automaker in China. With a current three-year contract that runs through 2024, it can produce 240,000 cars annually. Nio will need to construct its own factory, which will be expensive and time-consuming, if the deal is not extended.

Also Read: Is The Stock Market Going to Crash In 2023

Will Nio Stock Go Up?

The Nio stock price may decline sharply in the upcoming months as a result of several important catalysts.

Other elements, though, might cause the Nio stock price to decline. First, there is increasing competition in the EV sector. In China, Nio now faces competition from more than 400 EV manufacturers. XPeng, Li Auto, and BYD are a few of the leading rivals. This implies that the company’s growth will eventually slow down in the ensuing months.

Additionally, the stock has experienced a significant sell-off in recent months from a technical standpoint. At $11.71, the lowest point in May of this year, it also managed to fall below an essential support level. Accordingly, it appears as though there is a bearish momentum, which will make it difficult for the stock to recover any time soon.

Nio Share Price Analysis

The Nio share price has been experiencing a sharp sell-off recently, as evidenced by the daily chart. The shares fell to their lowest point on September 7, which was at $16.54, an important support level. The stock then fell below the critical support level at $11.71. It continues to be located below all moving averages and along the Supertrend indicator’s lower side.

Therefore, it is likely that the shares will keep decreasing as they try to dip below $10. The bearish view will be rendered invalid by a movement above $13.

Nio Stock Price Forecast For 2022

If Nio’s stock increases by 134% over the course of a year, it could reach $66 in 2022. We get that number by averaging the estimated growth from 12 of the most recent forecasts. The $66 forecast falls just short of the business’ all-time high, which was reached in early 2021. Not all analysts anticipate such a significant increase; Eunice Lee from Sanford Bernstein has a target price of $45 for the year.

Numerous analysts, including those from 86 Research, Macquarie, HSBC, Deutsche Bank, Mizuho, and Citigroup, are bullish on the price of the Nio stock.

Most analysts are bullish on the stock, according to a second, more comprehensive look by them. Additionally, data gathered by Tipranks reveals that the target price for the stock is $59, which is also higher than the price at which it is currently trading.

Long Forecast predicts that over the next few months, the price of the Nio stock will remain in a narrow range. At the end of 2022, they predict that the shares will be worth less than $30.

Nio Stock Forecast 2025

As history has shown us, it is challenging to forecast how a stock will perform in about three years. Nio’s situation is more unstable because it is a Chinese company that may be delisted from the American stock exchange.

By 2025, as electric vehicles become more commonplace, it’s possible that the Nio share price will rise, all other things being equal. As you are already aware, there are numerous nations with plans to phase out combustion engine vehicles, including those in Europe and even China.

Nio’s manufacturing procedure will be refined by 2025, and the company will have expanded internationally. In January 2025, the stock will trade for about $55, according to Long Forecast.

Nio Stock Forecast 2030

Due to the rapid growth of the business, I am generally somewhat bullish on the long term performance of the Nio stock price. Consequently, I think the stock will be significantly higher than it is right now. We cannot, however, rule out a scenario in which the stock increases threefold by 2030 to reach over $70, based on its historical performance. This is a plausible scenario, as Tesla has demonstrated.

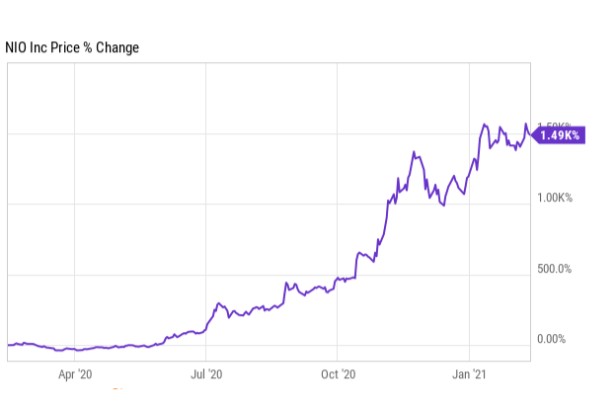

Nio Stock Price History

As can be seen from the chart below, Nio’s share price has fluctuated wildly since going public. The company went public in 2018, and after that, its stock price plummeted to an all-time low of $1.20. There were doubts about the company’s ability to continue operating at the time.

As the company prepared to launch its products, it then began a spectacular rally in November 2019. It has since increased by more than 5,400%, peaking at $65 at that time. The stock is currently about 65% lower than its all-time high.

Is Nio An Excellent Stock To Buy And Hold?

Nio is a good company, but it also carries a lot of risk. Because it is a Chinese company, doubts exist regarding the veracity of its financial results. Chinese businesses have a history of publishing false data.

The company might have its US listing revoked, which is another worry. Many American investors would end up on the hook if this occurred.

Nio Stock Short Interest

The quantity of shares held by short sellers is referred to as short interest. These are the people who wager on the decline of a stock. Since the Wall Street Bets incident, many companies’ short interest has decreased. With just $1.5 billion, the Nio short interest is at its lowest point in more than a year. Short sellers’ shares were worth over $4 billion at their highest point.

How Many Automobiles Did Nio Sell?

Nio is a relatively new business that is currently ramping up production. For a company of its age, Nio has sold over 160k cars, which is an impressive number. Analysts predict that over 500k cars will be sold annually in the following five years.

The Nio Stock: Is It Overpriced?

Nio is overvalued right now, just like the majority of EV stocks. In addition, this is a loss-making business with annual revenues of less than $4 billion that is estimated to be worth almost $35 billion. With a price-to-sales ratio of 5.89, the company is overpriced. If the business continues to grow, this overvaluation might be acceptable.

What Lies Ahead For The Ftx Nio Tokenized Stock?

The performance of the cryptocurrency market as a whole will have a significant impact on the future of Nio tokenized stock FTX. You must ensure that you are employing the appropriate strategy when investing in NIO. People with an asymmetric risk profile should not make this type of investment. It is still a great investment, though, for those who have a high risk tolerance and sound financial standing. NIO not only has a speculative nature but also exposes users to a global technology and a dynamic ecosystem.

Summary

The value of the Nio stock has increased over time. We have outlined why it has performed in that manner in this article. Additionally, we have noted current risks the company may be exposed to.