This page looks at the most recent price forecasts to give you an idea of how Tesla stock price might change in the future. Compare short term and long term predictions to help you make the best investment decisions.

In recent months, there has been a significant bearish trend in the price of Tesla stock. The price dropped to $197, the lowest point since June 7 of this year. Due to this, Elon Musk’s net worth, which was previously $183 billion, has decreased by more than $87 billion.

Everything You Need to Know About Tesla

A team of engineers with the vision to create fully functional, electrically powered vehicles (EVs) revolutionized the auto industry by founding Tesla in 2003.

Despite what many people think, Elon Musk did not start Tesla. Marc Tarpenning and Martin Eberhard were its creators. Musk was crucial to Tesla’s success, though, as he invested in the business and assisted in its efforts to attract angel and venture capital investors.

2008 saw the Roadster, Tesla’s first vehicle, go on sale. Later, the business unveiled new designs like the Model S, Model X, Model Y, and Model 3. The business is also working to introduce the Tesla Semi, a commercial truck, and the Cybertruck, a pickup truck for passengers. Additionally, the business intends to introduce a new Roadster model in 2023 and make it available to customers.

With its main office in Austin, Texas, Tesla is currently run by Elon Musk. China, Germany, Texas, Nevada, and California in the US are among the countries where the company has manufacturing facilities.

Tesla generated $53.8 billion in total revenue in 2021, of which $47.2 billion came from the sale of cars. Tesla made 930,422 vehicles during this time period and delivered 936,222 of them.

Check More Stocks Information in BtcAdv Blog!

Tesla Stock Latest News

Tesla has made several headlines in the most recent past few months. And most of the news has not been positive for the company.

First off, all signs point to Elon Musk buying Twitter. Musk will then hold the positions of CEO for Tesla, SpaceX, and Twitter. There are questions about whether he will be able to perform these roles to a sufficient level as a result.

According to Tesla, it delivered more than 343,830 vehicles in the third quarter, a 42% increase from the same period last year. Additionally, it exceeded the 310k car sales reported by the company in the first quarter. As such, it means that increased prices are not having a major impact on the company’s sales. Still, analysts believe that the situation will likely get worse in the coming months.

Meanwhile, Elon Musk recently said that the company was incinerating money as the cost of doing business surges. Finally, the business is currently up against fierce competition from companies like Ford and General Motors.

The company’s decision to recall about 54,000 vehicles due to a software flaw is another significant recent Tesla development. The problem is that the bug might lead the vehicles to disregard traffic signals. The effect of this recall on the price of TSLA stock is somewhat limited, though.

Finally, Tesla revealed that due to a slowing in demand, it will reduce the price of its vehicles by 9% in China. This price cut occurred as Musk forewarned that China was experiencing a slight recession.

What is the Tesla Market Cap?

The term market capitalization refers to the overall valuation of a company. It is calculated by multiplying the share price of a company by the number of outstanding shares. For instance, according to Yahoo Finance, there are 1 billion shares of Tesla outstanding. The market value of Tesla is $622 billion at the current share price of $197.

Also Read: Is The Stock Market Going to Crash In 2023

What is Elon Musk Net Worth?

Elon Musk is Tesla’s biggest shareholder and the company’s founder. While owning approximately 175 million shares of Tesla, Musk has reportedly been selling some of them, according to Bloomberg. That brings his total ownership to more than $95 billion, or a stake worth about 17.6%.

Due to the sale of his stock the previous year, he also has billions of dollars in cash. In particular, he is interested in SpaceX. Elon Musk is the richest person in the world according to estimates, with a net worth of over $187 billion. He has, however, lost about $87 billion of his wealth just this year, according to information gathered by Bloomberg. In order to purchase Twitter, he has also borrowed money secured by shares.

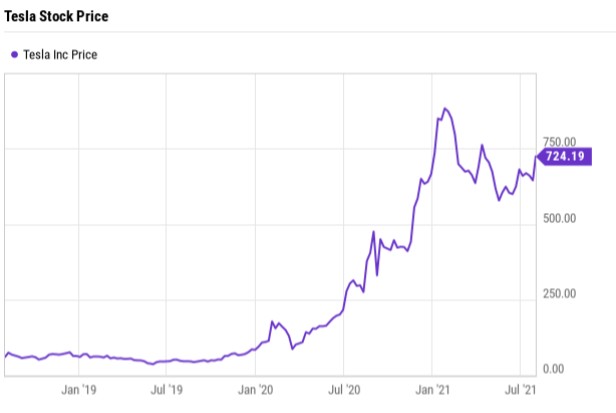

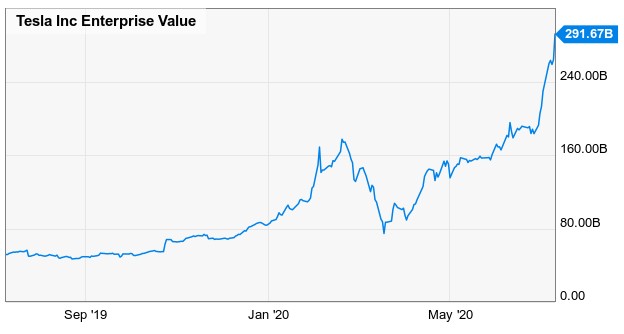

Tesla Share Price History

In 2010, Tesla began its initial public offering. The price of Tesla stock was $5 at the time it went public, split-adjusted. One of the best performers in the market since then, the TSLA stock has increased by more than 28,000%.

The road to the top has not been easy, despite the TSLA share’s positive long-term performance. The 2015 stock fell by 38% over a short period of time, as shown below. Similarly, it then dropped by 56% within a few months in 2019. At the time, Elon Musk even warned that he had funds secure to take the company public.

Is Tesla a Good Investment?

There are reasons to think Tesla is a good investment, even though its stock is overvalued. First off, the company enjoys a sizable market share in the rapidly expanding electric vehicle (EV) market. Tesla has kept its market share even though more businesses are entering the market. The chart below shows the Tesla market share in EVs.

Second, Tesla has several benefits that other companies like Rivian, Lucid, and Nio lack. First, it has manufacturing facilities in the key markets for the sector. It runs businesses in Germany, the US, and China. This indicates that it can create and market vehicles more quickly than most automakers.

Third, Tesla is equipped with the systems required to succeed in the EV sector. It has the largest network of superchargers, for instance. Since range anxiety is real, having that network is highly important.

The fact that Tesla is the only profitable EV company makes its stock a good investment as well. Others, like Rivian and Lucid, still have a ways to go before turning a profit. Most importantly, Tesla has the most cutting-edge software available. Key metrics for Tesla’s profitability are displayed in the chart below.

Is Tesla Overvalued?

Most analysts believe that Tesla is an overvalued company. The majority of them, however, defend this valuation in light of the company’s market share, revenue and unit growth, and upcoming initiatives like the semi and cybertruck. Tesla’s stock is wildly overvalued, according to a DCF valuation. It is fairly valued at $465 per share, which is a significant decrease from where it is right now.

The target price for Tesla stock is currently $934 according to analysts’ estimates on average. Bullish ratings come from Oppenheimer, Canaccord Genuity, and Credit Suisse. On the other hand, some of the analysts short the stock are from Barclays, JP Morgan, and Citigroup.

Tesla Stock Price Forecast 2022

The Tesla stock price appears to have formed a double top pattern at around $1,200, according to the daily chart. This pattern’s low point was around $884. In price action analysis, this pattern tends to be a warning that more weakness will happen,

An examination of the stock more closely reveals that it has recently had some difficulty moving below the chin. The level, however, has been successfully crossed. The stock is currently trading at the 200-day moving average and has fallen below the 50-day MA at the same time.

As long as concerns about the Federal Reserve persist, it is possible that the shares will reach a death cross. In the event that this takes place, $790 will be the next important support level to keep an eye on. If it breaks through below this point, it may fall as low as $563.

Tesla Share Price Analysis (Update)

We previously predicted the price of a Tesla share in the section above. This prediction came true, as you can see below, as the stock is still headed toward $563. The TSLA share price remains below the 25-day and 50-day moving averages and it has formed a triple top pattern. The stock’s overall outlook is therefore negative, with $500 as the next target.

The chart below displays Wall Street analysts’ monthly targets for the price of Tesla shares. According to the graph, the most upbeat analysts predict that Tesla will end the year with a value greater than $1,500, while the most pessimistic analysts predict that it will finish with a value lower than $500.

Long Term TSLA Stock Forecast

The majority of longer-term Tesla stock projections place the stock’s price between $1000 and $5000. It’s important to note that predictions for the future are more speculative, but it is still possible to gauge the size of the market for electric vehicles and set Tesla’s price accordingly. Some price goals for the upcoming ten years are listed below.

Tesla Price Prediction 2024

ARK Investment Management had a price target of $1400 for 2024, which they have since suggested might be on the low side. Many predictions are based on the fact that Tesla expects to increase sales by 50% annually, which would help the company to keep increasing its share price up into the thousands of dollars.

Tesla Price Prediction 2025

$3,000 is one price target for Tesla in 2025, assuming that their market share for EVs increases significantly over the ensuing few years. According to ARK analysts, the company could sell approximately 10 million cars by that time, a 20-fold improvement over its 2020 results.

Tesla Price Prediction 2030

The Tesla share price could reach $45,000 by 2030, a fifty-fold increase from the 2021 value, according to the most optimistic prediction of all. According to that estimation, the company would be worth $1.5 trillion.

Tesla Stock Price Prediction 2025 and 2030

By 2025 and 2030, I anticipate that TSLA shares will be substantially higher than they are right now. As the world switches to electric cars, the business will be very profitable at that time. As can be seen in the chart below, Wallet Investor analysts forecast that the stock will trade at or above $2,500 in 2025. In a similar vein, Cathie Wood predicts that by 2030, the stock will have surpassed $3,000.

What Affects the Price of TSLA?

The most significant element influencing Tesla is the demand for electric vehicles. A brief list of all the most significant ones is provided below. In addition to that, there are a number of other factors that are relevant.

- Electric vehicle sales. Demand is essential because selling new cars is Tesla’s primary business. This demand is influenced by factors like environmental awareness and the practicality of owning and charging an electric car. To satisfy investor expectations, Tesla must keep growing its sales figures.

- Supply chains. A Tesla is made up of numerous moving parts, both physically and figuratively. Lithium batteries and semiconductors are part of the supply chain in addition to raw materials, and any shortage of either of these components could slow down supply and impact sales.

- Elon Musk. Several price changes in Tesla are influenced by Musk’s personality and actions. Because of his creation of a cult of personality, which has contributed to the success of the company, even his tweets—like one in which he asked followers to vote on whether or not he should sell company stock—can affect the market.

- Bitcoin price. The price of Bitcoin, which Tesla purchased in large quantities in 2021, has a significant impact on the balance sheet. Tesla’s stock price is probably going to be impacted in some way by a significant decline or increase in Bitcoin.

- Competition. There are more EV manufacturers than ever entering the market, and traditional motor companies like Ford and General Motors have started to invest heavily in electric vehicles as well. To keep its stock price rising, Tesla must keep its competitive edge.

How Has the Tesla Price Changed over Time?

Tesla stock has surged in value over the last couple of years. It was trading at $100 at the start of 2020, before the pandemic. Within two years, the value of each share had increased to over $1,000, and in 2021, the stock doubled its previous record high.

These abrupt price increases and decreases are hallmarks of the Tesla brand. Although it attracts younger, tech- or climate-focused investors particularly well, a large portion of its price is based on hype, frequently fueled by Musk’s remarks. Any bad news can put a stop to things, and it’s not unusual to see changes of several percentage points in a single day.

Tesla Stock Split

In 2022, Tesla intends to divide its stock. An organization does this when it multiplies the total number of shares outstanding and distributes new stock to all current shareholders. Tesla has not yet made public the ratio of the split, but in 2020 it split its stock at a 5:1 ratio, meaning that each shareholder received four additional shares (though the value of those shares at the time of the split remained the same as if they had one share).

A stock split may occur for a variety of reasons, but in Tesla’s case, it usually occurs to make it simpler for the average investor to purchase stock in the company. For instance, after a 5:1 split, each share costs $200 as opposed to $1000.

If you’re looking at Tesla stock price predictions for many years in the future, be sure to keep this in mind. The company’s shareholders must still approve the stock split before it can take effect, but if they do, all future price forecasts must be revised.

Tesla Biggest Shareholders

Tesla is a publicly-traded company, meaning that anyone can buy the stock. As mentioned, Elon Musk owns about 17% of the company. Likewise, 41% of the company is owned by 1,937 or so institutional investors. This means that retail investors own about 42% of the company. Blackrock, Vanguard, Capital Group, and Baillie Gifford are the top Tesla stockholders.

Will Tesla Stock in 5 Years Go Up Or Down?

According to data from MarketBeat (as of 3 Although 19 out of 36 analysts gave the stock a “buy” rating (as of November), the consensus recommendation from analysts was to “hold” Tesla stock. Ten analysts advised “hold,” while seven analysts gave it a “sell” rating.

Based on the price of $216.54 as of 3 November, the average TSLA stock price target was $273.10, which would represent a 26.12% upside potential. Analysts’ predictions for Tesla’s stock ranged from $526.67 to $33.33, with $526.67 being the highest and $33.33 being the lowest.

As for the long-term outlook for Tesla stock, the third-party forecasting service WalletInvestor estimated In five years, the price of TSLA could increase by more than 200% to an average of $784.837. In a more short-term Tesla stock price prediction, WalletInvestor’s forecast for the end of the current year was a potential average price of $254.15.

Another algorithm-based forecasting service Gov Capital had a baseline The five-year forecast for Tesla stock is $1,584.258 by early November 2027.

Both projections showed that TSLA had a significant upside potential over the following five years. But a lot of things might occur then that would influence the price.

It’s critical to keep in mind that predictions made by analysts and by algorithms are subject to quick change and are not always accurate. They are based on an analysis of the TSLA share price history. Future success is never assured by past performance. Before making any trading decisions, traders should conduct thorough due diligence on the company. Never put money into an investment that you cannot afford to lose.