Do you use Coinbase Pro and need to file your cryptocurrency taxes?

Coinbase Pro sends 1099-MISC forms to users and the IRS if you are a US customer of Coinbase and have earned more than $600 through rewards or staking.

In this article, we’ll explain the fundamentals of cryptocurrency taxation and delineate a straightforward three-step procedure to assist you in filing your Coinbase Pro taxes with the IRS.

What is Coinbase Pro?

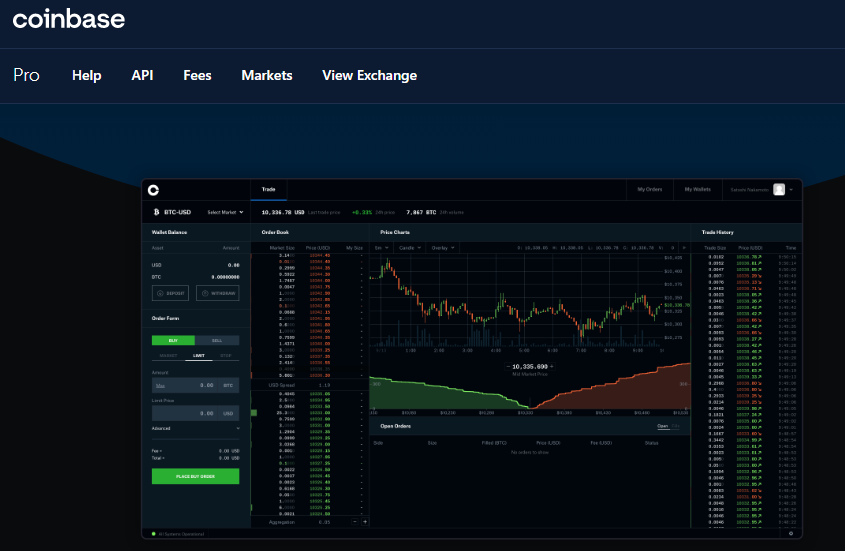

A brand-new platform for committed cryptocurrency traders was launched by Coinbase in 2015. Before adopting the name Coinbase Pro in 2018, the platform’s previous moniker was GDAX. The platform provided users with cutting-edge cryptocurrency trading options and affordable trading costs.

Coinbase ended support for Coinbase Pro in 2023. These days, Coinbase Advanced Trade offers many of the platform’s features.

What Taxes Do You Need to Pay on Coinbase Pro?

Let’s go over the fundamentals of cryptocurrency taxes so you can know how much you’ll be paying in taxes on your Coinbase Pro transactions.

The IRS views cryptocurrencies as a type of property that is chargeable with both income and capital gains taxes.

Income tax: You will be subject to ordinary income tax if you receive money in the form of cryptocurrency. Getting interest on cryptocurrencies would fit into this category.

Capital gains tax: Every time you sell a cryptocurrency, you either make a profit or a loss. This includes exchanging your cryptocurrency for another cryptocurrency or selling it on Coinbase Pro.

Check out our comprehensive guide to cryptocurrency taxes for more details.

Does Coinbase Pro Report to the IRS?

Coinbase Pro sends out 1099-MISC to users and the IRS if the following conditions are met:

- You are a Coinbase customer AND

- You are a US person for tax purposes AND

- You have received rewards or fees from Coinbase Earn, USDC Rewards, and/or Staking totaling at least $600.

It’s crucial to keep in mind that this form is not sufficient to report your taxes. The 1099-MISC is designed to assist users in reporting other rewards-related income, but it does not list every taxable event, such as your capital gains and losses from selling cryptocurrency.

All exchanges, including Coinbase Pro, will eventually need to give users and the IRS more thorough tax reporting data. The 2021 American infrastructure bill mandates the submission of 1099 forms with capital gains and loss disclosures from parties facilitating cryptocurrency transactions.

Does Coinbase Pro Keep Track of Your Taxes?

You do receive a record of your cryptocurrency transactions from Coinbase Pro.

If you transfer your cryptocurrency into or out of the platform, cryptocurrency exchanges struggle to keep track of your profits and losses. In scenarios like this, your exchange won’t be aware of the original cost basis of your assets, which could make it difficult for it to determine your gains and losses.

We advise using cryptocurrency tax software to obtain a complete record of all of your cryptocurrency transactions. To make filing your cryptocurrency taxes simple, CoinLedger can compile all of your transactions from various wallets and exchanges.

How to Do Your Coinbase Pro Taxes

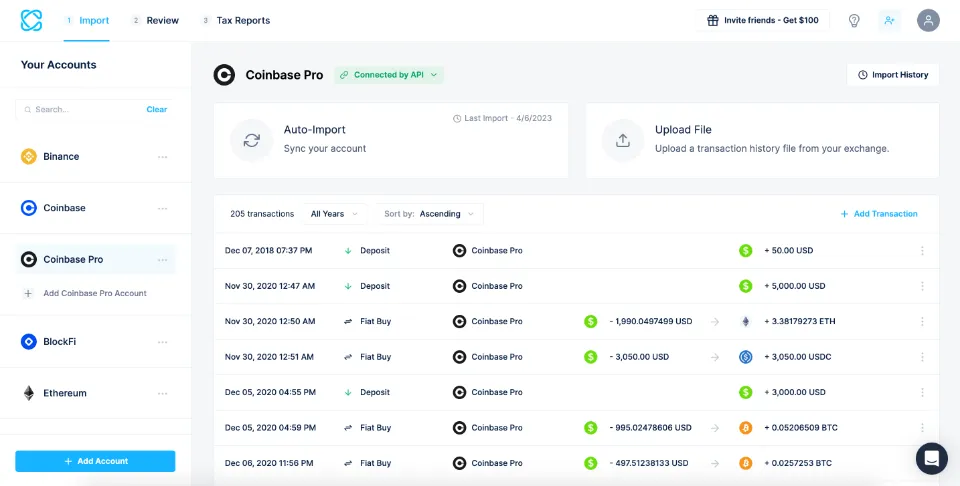

You can still upload your transaction history to CoinLedger and watch the platform automatically calculate your taxes and generate the necessary tax forms even though you can no longer make purchases on your Coinbase Pro account.

Here’s how you can include all of your Coinbase Pro transactions on your tax report within minutes:

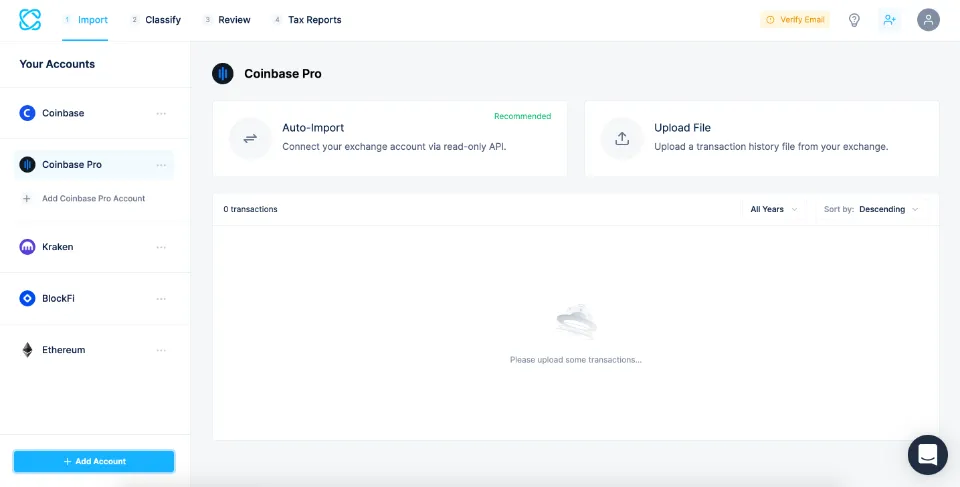

1. Within CoinLedger, click the “Add Account” button on the top left.

2. Locate Coinbase Pro in the list of supported exchanges and choose your preferred import strategy.

3. Using an API connection, you can automatically import your Coinbase Pro transactions, or you can manually import them using a CSV file.

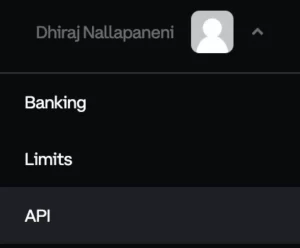

4. If you want to import your trades using an API, you can create a read-only API key in Coinbase Pro’s “Settings” menu under “API.”

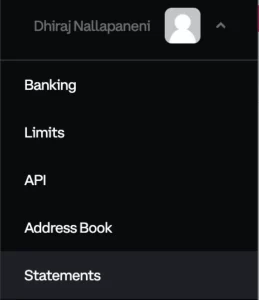

5. As an alternative, you can download a CSV file from Coinbase Pro’s “Statements” section.

After you’ve finished importing your transactions from Coinbase Pro and any other cryptocurrency exchange you’re using, you can generate a full tax report with a single click.

Will Coinbase Pro Provide Me With Tax Documents?

Unfortunately, there is a reason why Coinbase Pro and other cryptocurrency companies have trouble providing you with thorough tax information.

To move their money, the majority of cryptocurrency investors use a variety of exchanges, wallets, and platforms. Only transactions that occur on Coinbase Pro’s platform are visible, for instance. If you buy or sell your bitcoin on a different platform, Coinbase Pro won’t be able to track your cost basis and determine your overall crypto tax burden.

Fortunately, there is a different way for investors to obtain and properly file their Coinbase Pro tax documents. In addition to finding opportunities for you to save money and trade more wisely, ZenLedger quickly calculates your cryptocurrency taxes. Let’s explore how to use ZenLedger to complete your Coinbase Pro taxes.

Connecting Your Coinbase Pro to ZenLedger for Your Crypto Tax Documents

We have import instructions for well over 400+ exchanges, making us one of the most complete cryptocurrency tax software options available on the market.

Choose the Exchange you want to import in ZenLedger by clicking on the Exchanges tab on the Import Transactions page. A table outlining the potential approaches will then be displayed. We support a direct API code import for many centralized exchanges, but a CSV import may be necessary for others. A wallet address might be required by decentralized exchanges.

To import your transactions from an exchange, simply navigate to the [Exchanges] tab of the [Imports] page. Choose the exchange you want to import data into (in this case, Coinbase Pro), and instructions for that particular exchange will be provided!

The Bottom Line

Busy traders may want to consider Coinbase Pro because of its fantastic user interface. Users can buy, sell, and trade over 130 cryptocurrencies on the website, and fee reductions are available for high-volume trading. If account security is a concern for you, Coinbase is worth taking into account because of its strong security and compliance record.

If you want to make more sophisticated investment decisions, Coinbase Pro is a great alternative. The numerous options, despite being simple to use, may be confusing. However, you’ll pay much less in fees and be able to do much more on the Coinbase Pro platform.

Coinbase Pro Taxes FAQs

Does Coinbase Pro Tax?

In the US, cryptocurrency is categorized as a digital asset, and the IRS treats it the same way as stocks, bonds, and other financial assets. There will be gains or losses in capital when you sell your bitcoin. This includes repurchasing other cryptocurrencies on Coinbase Pro or selling your bitcoin.

Does Coinbase Pro Report to IRS?

The 1099-MISC form is sent to users and the IRS by Coinbase Pro if you are a US customer who has earned more than $600 in rewards or staking. Although the IRS must be notified of all taxable events, the 1099-MISC is designed to make it easier for users to report miscellaneous income from awards.

How Do I Collect Taxes on Coinbase Pro?

For some reason, Coinbase Pro and other cryptocurrency find it challenging to provide you with thorough tax information. In addition to finding opportunities for you to save money and trade more wisely, ZenLedger quickly calculates your cryptocurrency taxes.