Trading 212, which is best known for its mobile trading app, provides a simple-to-use platform suite for trading CFDs, shares, and a wide range of forex pairs. Trading 212’s efforts to be regarded as a top broker are hampered by its lack of cutting-edge trading tools and mediocre research offerings, despite its well-designed platform and large selection of symbols.

Trading 212 Pros & Cons

Pros

- Easy-to-use web trading platform and mobile app that gave Trading 212 a Best in Class ranking for usability in our yearly review.

- 1,785 symbols in a wide variety are available for CFD and forex trading.

- supports a number of exotic FX pairings, including 16 against the lev.

- offers indemnity insurance from the Cypriot regulator for more than 1,000,000 euros and over 20,000 euros.

Cons

- There are no news headlines available in the mobile app besides the events on the economic calendar.

- The web platform’s research capabilities are restricted to snippet-like updates and sentiment data.

- Even though Trading 212 has a lot of videos, there aren’t many written educational articles on the site.

- There is no MetaTrader available.

What is Trading 212?

A UK broker called Trading 212 provides financial trading services to clients all over the world.

Founded in Bulgaria and headquartered in London since 2004, the broker now has around 1.5 million clients and 3.5 billion euros in client assets around the world. Its mobile trading app has been downloaded more than 14 billion times and it has been the #1 in the UK since 2016.

Despite having begun as a forex broker, it has expanded enough to now offer additional products like stocks, ETFs, commodities, and CFDs. In this Trading 212 review, we’ll give you all the information you need to decide if this broker is the best fit for you.

Is Trading 212 Safe?

With a total Trust Score of 77 out of 99, Trading 212 is rated as having average risk. In addition to not having a bank, Trading 212 is not traded publicly. Trading 212 is permitted by one regulator at the tier-1 level (high trust), one regulator at the tier-2 level (average trust), and none at the tier-3 level (low trust). Tier-1 regulator Financial Conduct Authority (FCA) has granted Trading 212 authorization. Find out more about the Trust Score.

Offering of Investments

Trading 212 provides traders with access to exchange-traded securities like fractional shares as well as CFDs on 29 commodities, 36 indices, 1536 shares, and 184 forex pairs.

Cryptocurrency: Trading 212 no longer provides cryptocurrency trading.

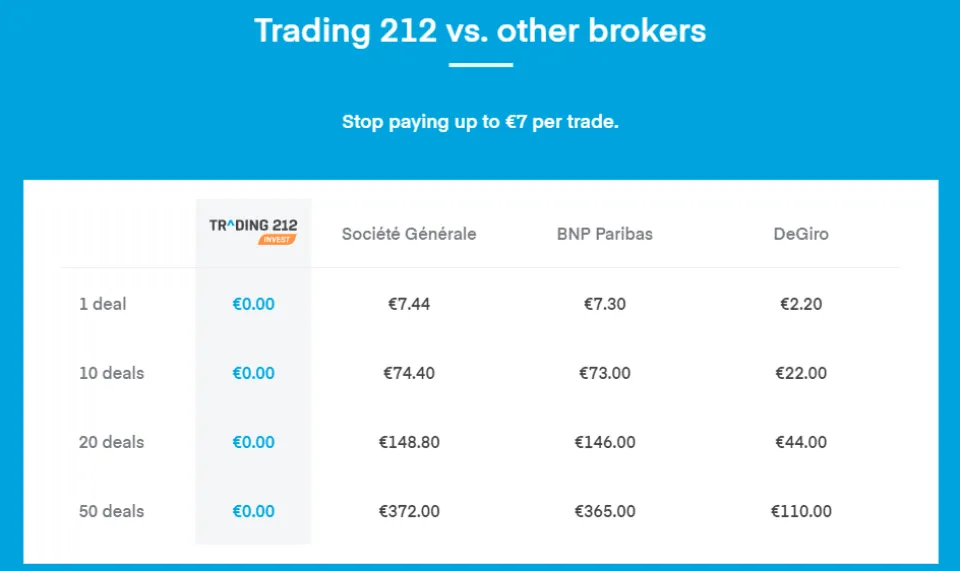

Commissions and Fees

For trading shares and CFDs, Trading 212 offers two accounts: Invest and CFD. The minimum deposit for the Invest account is one euro, while the minimum deposit for the CFD account is ten euros. The CFD account is the main subject of this evaluation. Read our U.K. article for more information on the Invest account. Trading 212 evaluation by StockBrokers.com.

Trading 212 promotes zero-commission trading, but when trading CFDs and forex, you will still have to pay a spread. In order to better explain its pricing for currency pairs like the EUR/USD, Trading 212 does not publish an average spread.

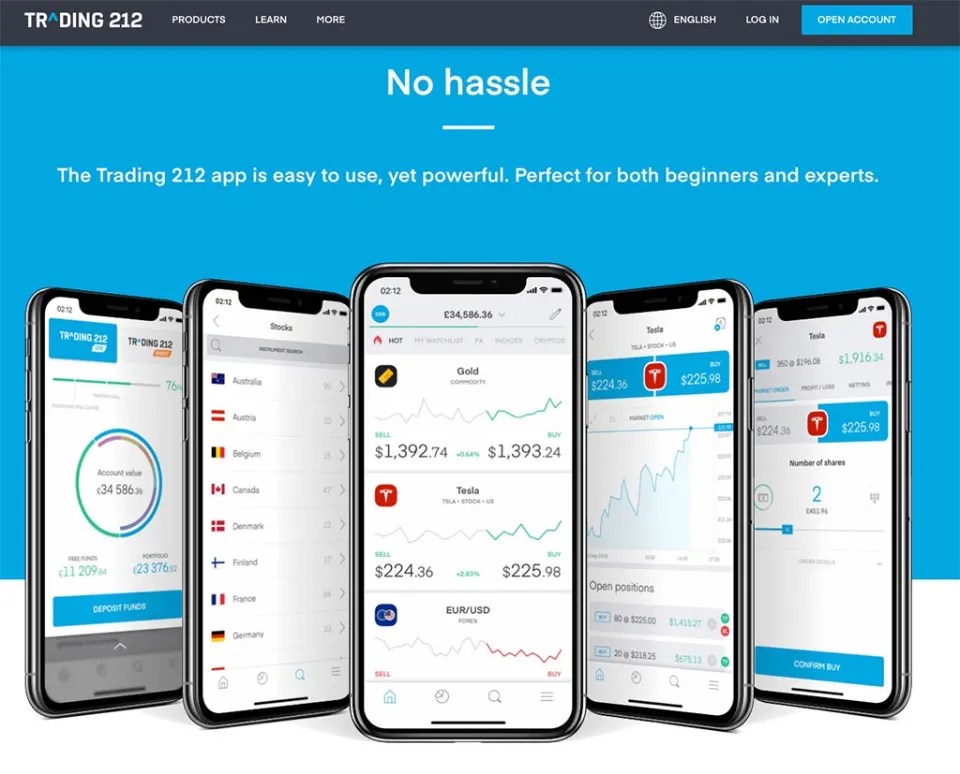

Mobile Trading Apps

With over 10 million downloads on the Google Play store, the Trading 212 app has undeniably gained popularity. Beginners will benefit from the app’s integration of instructional video content, but experienced traders will be disappointed by its lack of advanced features, especially when compared to the best trading apps for mobile devices.

Apps overview: For Android and iOS devices, Trading 212 provides an incredibly user-friendly mobile app. Sorting through markets like stocks, forex, indices, and newly added symbols is simple with the default watch list screeners.

The absence of significant research tools is the Trading 212 app’s biggest flaw, in my opinion. It does have an extensive economic calendar that usefully lists upcoming activities for any given symbol.

Ease of use: The platform can be quickly accessed from within the browser thanks to Trading 212’s own Google Chrome plugin, which is unique among the brokers I’ve reviewed. It’s also important to point out that its watchlists can be customized and sync with the web platform automatically. These characteristics contributed to Trading 212 receiving a Best in Class ranking (top 7) for Ease of Use in our yearly review.

Charting: The charting tool in the app has been seamlessly integrated with 19 drawing tools and 45 indicators. The mobile app and corresponding web version are almost functionally identical.

Trading tools: Unfortunately, good-till-date order expirations are not yet available and instead default to good-till-cancel. The app’s customization options still have a lot of room to grow, as evidenced by these kinds of minute details.

Upcoming events: When viewing the symbol properties of a specific instrument, such as the EUR/USD, one feature that stands out in the Trading 212 mobile app experience is the capability to view upcoming events. Along with the event’s likely effects, forecast predictions, and precise time, they are all displayed. One thing I would mention is that it would be convenient to be able to subscribe to and receive alerts regarding any specific event. I have seen this feature on the trading platform of CMC Markets.

Trading 212 Account Types

You’ll discover you can select between two account types when you first try to open a Trading 212 account.

Let’s take a look at both of them, one by one…

Trading 212 Invest

Equities, such as stocks and ETFs, can be traded through Trading 212 Invest. That is the only item you will be able to trade if you choose this type.

Due to the significantly lower risk, Trading 212 Invest is a great account for beginners to start with.

Trading 212 CFD – Trading CFD Account

With 212 CFD, you can trade CFDs (Contracts For Difference) on a variety of products, including forex, stocks, indices, and commodities. You can only trade one kind of security (in this case, CFDs), just like with the other account.

Due to the use of leverage in CFD trading, it is only appropriate for more experienced and risk-tolerant traders. If you don’t know what you’re doing, you could lose a significant portion of your initial investment.

What is CFD Instrument Trading

In case you don’t know too much about these instruments, CFD stands for “contract for difference”. Because CFDs are traded on margin, the trader is only required to put up a small portion of the asset’s total value as collateral. With only a small amount of capital, you can do this to get exposure to big positions. The risk is still very high. In actuality, trading CFD instruments on this platform results in losses for 83% of retail investor accounts.

Trading 212 Platform & Features Review

Web Trading Platform

You can trade on the Trading 212 website. Both of them have a very user-friendly layout that is suitable for those with little prior trading experience.

The fact that you cannot customize it, however, is a disadvantage that may be significant for savvy traders.

Reports

The broker also provides portfolio and fee reports that are very simply structured. With just a few clicks, you can quickly view your interest that has been charged or earned, your cash balance, or your profit or loss.

But it’s important to point out that there doesn’t appear to be an exportation feature in this case.

To access your reports, simply click on your username and then select “Report”.

Alerts & Notifications

The platform lets you set price alerts for notifications. To do so, just select an asset and then click the “Alert” icon.

Order Types

Here’s a list of all of the order types that Trading 212 offers:

- Market

- Limit

- Stop

- Stop limit (Only with an Invest/ISA account)

- OCO (Only with a CFD account)

Trading 212 AutoInvest

You can invest passively through Trading 212 while adhering to the design of your portfolio.

You can invest your money automatically in line with your target allocations using AutoInvest, the broker’s autotrading feature. Just consider how time-consuming it would be to manually allocate a certain amount of your funds to each pie-shaped component of your portfolio.

For illustration, suppose you deposit EUR 1000 into your account and divide your pie into 4 equal slices with 25% target allocations. AutoInvest will let you put EUR 250 into each slice if you want to invest that cash in accordance with the layout of your portfolio.

For investors who want to regularly add to their retirement accounts, this is pretty convenient.

Mobile Trading App

The order, search, and alert features of Trading 212’s mobile trading app are quite user-friendly and function just as well with the app as they do with the web platform.

To ensure the security of your account, it offers a two-step authentication process, and you can choose to set a biometric authentication requirement if you so choose.

Regarding availability, you can download it in the same languages that you can choose on the web platform for both Android and iOS.

Finally, push notifications can be used to get price alerts. Sadly, it doesn’t appear that there is a way to receive email or SMS notifications.

Trading 212 Fees & Commissions

Trading 212 Invest

A Trading 212 Invest account allows you to trade stocks and ETFs completely free of charge. Just bear in mind that if the stock/ETF is in a different currency than your base one, you will incur a 0.15% currency conversion fee for each transaction.

When you deposit money via a debit/credit card or digital wallet, you will pay no fees until the total deposited amount reaches EUR 2000, but a 0.7% fee will apply thereafter. It should be noted that Trading 212 will only accept deposits of at least 10 euros.

A wire transfer, which will cost 10 euros instead, might be more affordable if you need to deposit a large sum. However, before choosing this route, find out how much your bank charges for wire transfers.

Withdrawals from this kind of account are free.

Trading 212 CFD

If you choose a Trading 212 CFD account, the transaction fee for forex will vary depending on the underlying pair since each one has a different spread. But the broker charges a standard 0.5% conversion fee.

You will not be charged anything for depositing funds but a minimum deposit amount of 10 euros is required.

You will be charged an interest SWAP if you leave a position open over night.

What Can You Trade on Trading 212?

Let us now examine all of the assets that Trading 212 has available for trading…

Trading 212 Invest

Stocks and ETFs can be traded for free with Trading 212 Invest. Although the selection of products offered here may not be as extensive as that of other online brokers, there are thousands of them, so there is a good chance you will find what you’re looking for—especially if it is listed on a significant exchange.

Trading 212 CFD

With Trading 212 CFD, you have access to contracts for difference (CFDs), a class of asset that Trading 212 first started providing in 2005.

CFDs on currencies, stocks, indices, and commodities are all available for purchase. For CFD trading, there are thousands of assets.

A contract for difference is an agreement between a buyer and a seller that specifies that each party will pay the other the difference between an underlying security’s opening and closing prices.

The direction of the price of the underlying security determines who pays whom. When you purchase a CFD on a stock that you believe will increase in value, the person who sold you the CFD is responsible for paying you the difference between the price the stock was trading at when you purchased the CFD and the price it had when you closed your position

If you don’t want this, no problem. It might be helpful for beginners, I just thought.

Trading 212 Customer Support

When it comes to the way they handle problem-solving and their availability, customer support on Trading 212 is excellent.

They are reachable by email or live chat. Unfortunately, phone support is not offered. Fortunately, you can get in touch with them whenever you want.

Remember that if you need support via email, you will be required to complete a form. But that’s okay because reading the pertinent articles that are suggested once you submit the form will allow you to find the answer to your question.

How to Open An Account on Trading 212

You can open an account with Trading 212 by simply following the below steps:

- Together with your personal information (email, birthday, etc.), enter the nation where you currently reside.)

- Enter your tax information, including your tax ID and the nation in which you file your taxes.)

- Choose the account type you’re interested in (Trading 212 Invest or Trading 212 CFD) and your base currency

- Answer the questions related to your financial situation, employment status, and trading experience

- Accept the terms and conditions and verify your identity/residency to activate your account

Regarding that last step, here are the documents you will need to provide to activate your account:

- A national ID, your passport, or driver’s license to verify your identity

- A bank statement or utility bill not older than 3 months to verify your residency

How to Trade Stocks on Trading 212

Setting up trades on the platform is very easy.After you open a Trading 212 Invest account, here are the steps you need to follow to buy a share of any stock available on the platform:

- Let’s imagine that you want to purchase Tesla stock. To find the stock, click the magnifying glass and type in “TSLA”, the stock’s ticker symbol.

- You will now have the option to choose the order type you desire. If you want to keep things simple, just go with the default type “market order”, which is going to allow you to buy the stock at the current price it is trading at.

- Next, decide how many shares you’ll purchase; this, along with the price at which you’ll do so, will determine how much money you’ll put into the business. Therefore, before you confirm the order later, make sure you understand the total cost.

- Lastly, hit “Buy” and confirm the order after you review the details.

Basically, that is it! If you chose the market type and the market is open, your order will be executed in a matter of seconds. If you don’t place your order during market hours, it will be filled as soon as the market is open.

Now, let’s go over the steps you need to follow to sell the shares you bought:

- Just next to the magnifying glass icon, click the pie-shaped icon. You can now access all of the holdings in your portfolio.

- Using our previous example, just select the Tesla position and then hit “Sell”.

- Following that, the platform will show you the same window that it did when you purchased the stock. Here, you can pick how many shares you want to sell.

- After you select an amount, just hit the “Send Sell Order” button to confirm the order.

And now that you understand how to buy and sell shares on Trading 212, you’re prepared to begin trading!

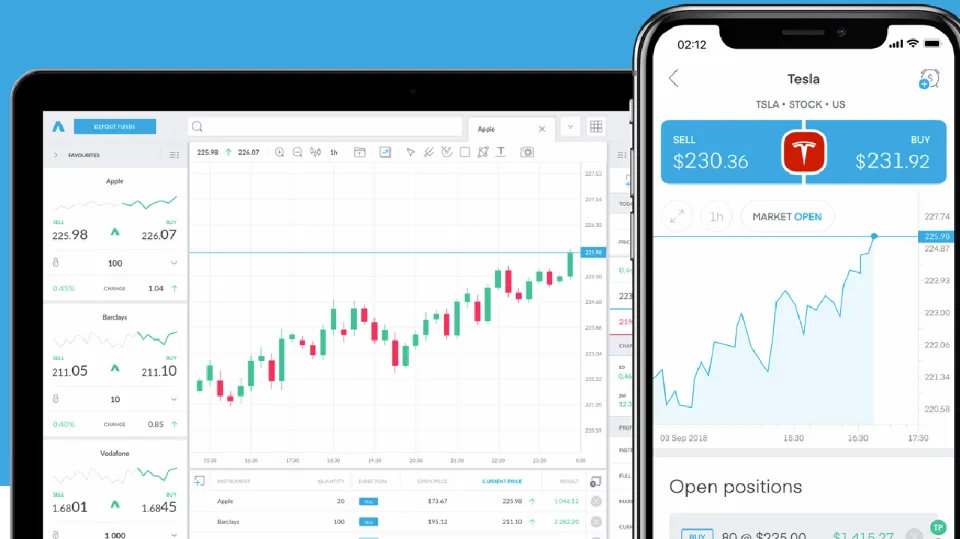

Other Trading Platforms

Platforms overview: In addition to its multi-asset offering, Trading 212 also provides a web-based trading platform. You will have access to both of its accounts—CFD and Invest—as well as their corresponding markets, just like with its other platforms. The platform’s majority of features are simple to use, and it boasts a clear, straightforward layout with powerful charts and integrated news headlines.

One beneficial feature that Trading 212 and eToro have in common is that both stores a user’s login information locally so that they are already signed in when they access the platform through their browser.

Charting: Like the mobile app, Trading 212’s web platform has reliable charting. You have a choice of five different types, 45 indicators, and 19 drawing tools. You can design and save your own chart templates, which I’ve found useful for applying settings to various charts. One notable, albeit minor, restriction is that while you can open multiple charts and switch between them, you cannot remove a chart from the platform.

Trading tools: The mobile app’s helpful feature, which lets you look at a given instrument’s symbol to quickly find out what events are coming up, is absent from the web platform. To view those events, you must manually open the economic calendar the old-fashioned way.

Market Research

A little bit more than the bare minimum is all Trading 212 offers in terms of research, which is not particularly strong. Users have access to a hotlist of popular trading symbols, news headlines and analysis, and an actual useful economic calendar.

Research overview: From its web trading platform, Trading 212 offers daily market analysis for a variety of instruments. But there is a dearth of research, and what there is seems to be outdated already. For instance, the most recent video posted to its YouTube channel was made in August 2021, more than a year before our testing period.

Market news and analysis: The web platform of Trading 212 offers news summaries and nearly a dozen technical analysis snippets, all of which include price references for well-known CFD markets like forex, commodities, and metals.

Education

With more than 170 available on its YouTube channel, Trading 212 offers a good selection of educational videos. The help center is the only place to find in-depth articles and advanced materials, and webinar recordings are not available.

Learning center: The majority of Trading 212’s video-based educational content is embedded in both its web and mobile platforms. Trading 212 does not provide educational articles besides a few entries in its community forum and FAQs in its help section.

Room for improvement: The addition of educational tools like articles arranged by experience level and quizzes for assessing and tracking your progress, which I’ve discovered on the platforms of the best brokers, would be beneficial for Trading 212.

Final Thoughts

Trading 212 has done a fantastic job of streamlining its platform to make it easy for new users to use.

On its website, web, and mobile app, the company’s research offerings are shallow. Comparing Trading 212 to the best forex and CFD brokers, more seasoned traders might find themselves wanting more.